THIRD QUARTER 2025 SUPPLY DELIVERIES WERE DOWN SHARPLY

CCRSI RELEASE – September 2025

(With data through August 2025)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through August 2025. Based on 1,479 repeat sale pairs in August 2025 and more than 331,048 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

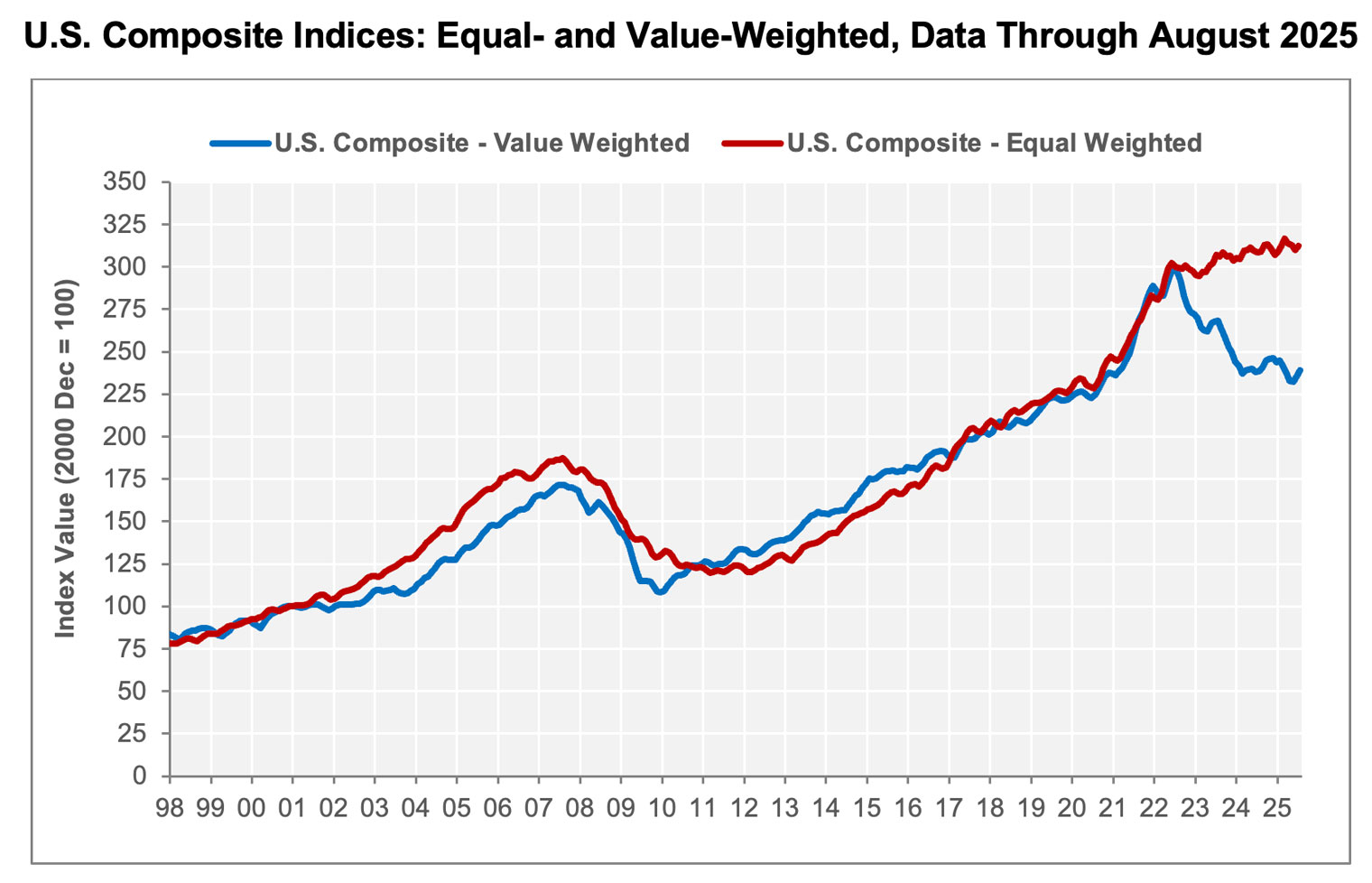

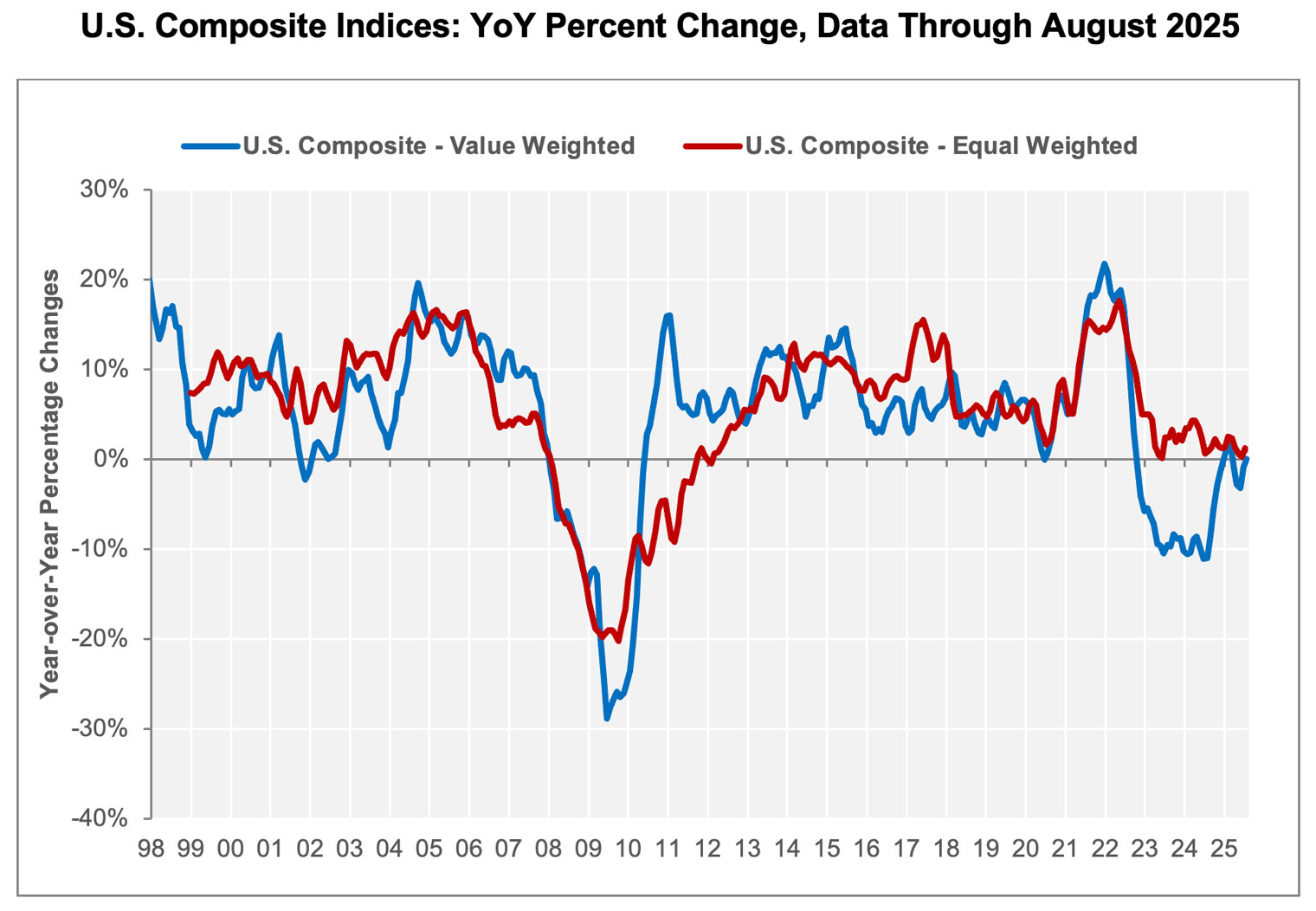

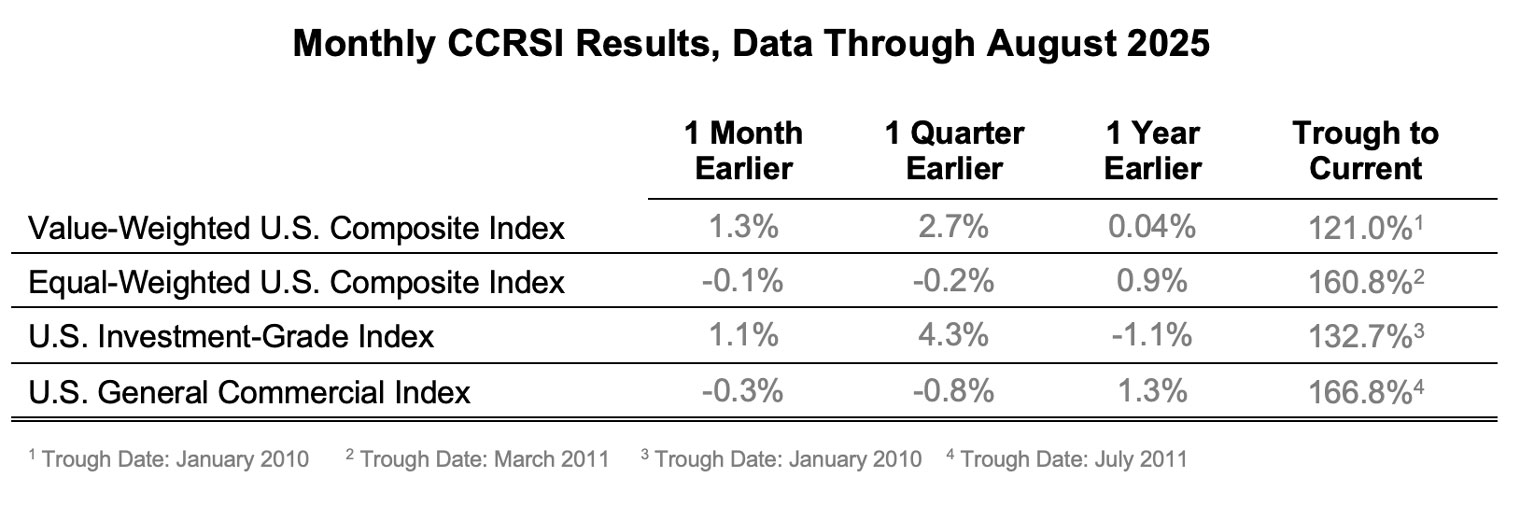

- U.S. COMPOSITE PRICE INDICES WERE MIXED IN AUGUST 2025. The value-weighted U.S. Composite Index, more heavily influenced by high-value trades common in core markets, increased for the second consecutive month to 239, a gain of 1.3% compared to the prior month. Measured against August 2024, the index was flat and was off by 20.1% from the July 2022 all-time high.

- Meanwhile, the equal-weighted U.S. composite index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, declined 0.1% during the month to 312 in August 2025. The index increased 0.9% in the 12 months ending in August 2025 and was 1.5% below the March 2025 all-time high.

- After four consecutive months of year-over-year value-weighted price declines, August 2025 marked a pause in this downward trend. The value-weighted U.S. composite index was even with levels from August 2024 and on par with March 2021.

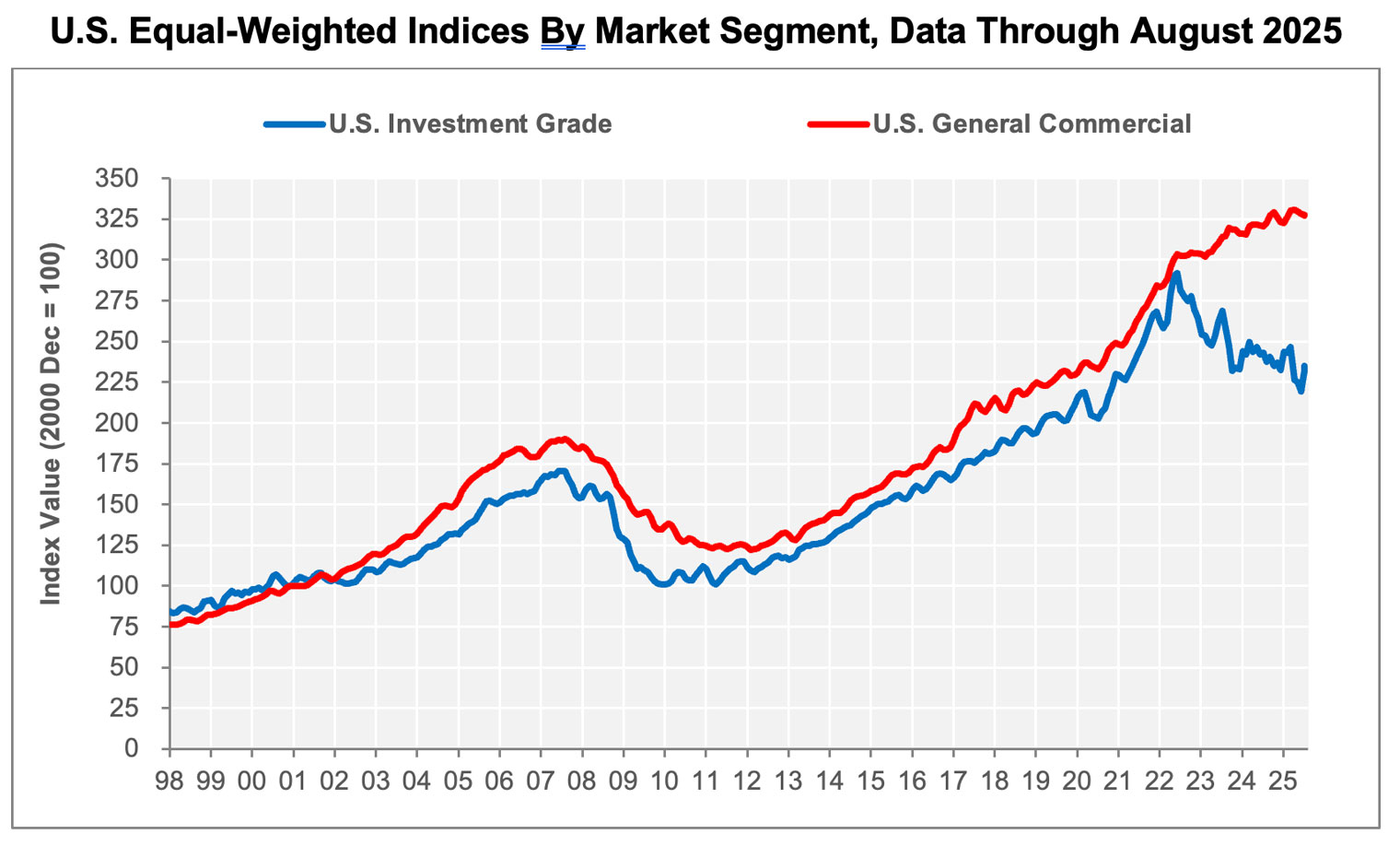

- EQUAL-WEIGHTED PRICE INDICES FAVORED LARGER ASSETS IN AUGUST 2025. Property values of smaller repeat sales declined while investment-grade values increased in August 2025, up 6.9% in the last two months.

- The investment grade sub-index, more heavily influenced by higher-value assets, rose 1.1% in August 2025 from the prior month, after spiking 5.8% in July 2025. The index declined 1.1% over the 12-month period that ended in August 2025 and was 19.5% below the June 2022 all-time high.

- The general commercial sub-index, more heavily influenced by smaller, lower-priced assets, fell 0.3% in August 2025 from the prior month, marking the fourth straight month of declines. This sub-index sits 1.1% below the April 2025 all-time high of 331 on the index, up 1.3% in the 12-month period ending in August 2025.

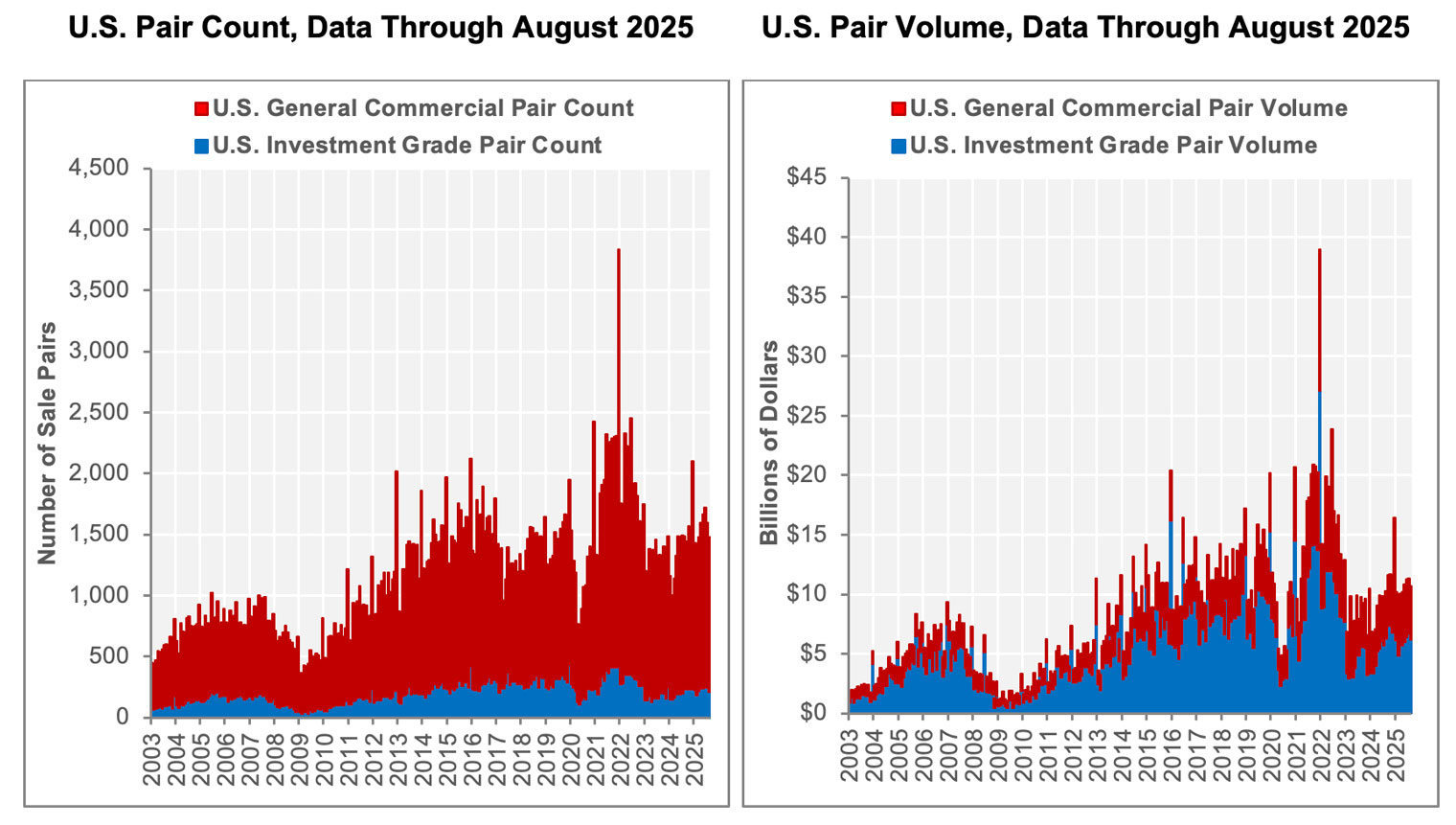

- YEAR-OVER-YEAR TRANSACTION VOLUME MOVED HIGHER IN AUGUST 2025. Transaction activity climbed to $10.7 billion in August 2025, a 3.6% increase from August 2024. Investment grade transaction volume fell 0.2% in August 2025 to $6.2 billion, while the general commercial segment climbed 9.7% over the prior year to $4.4 billion.

- Composite pair volume of $133.9 billion during the 12 months ending in August 2025 was 27.8% higher than the 12-month period that ended in August 2024. The investment grade segment increased 33.5% over the 12 months that ended in August 2025 to $79.7 billion, accounting for 58.6% of the overall annual transaction volume to date. The general commercial segment accounted for 41.4% of the 12-month transaction volume, rising 20.3% over the 12 months ending in August 2025 to $54.2 billion.

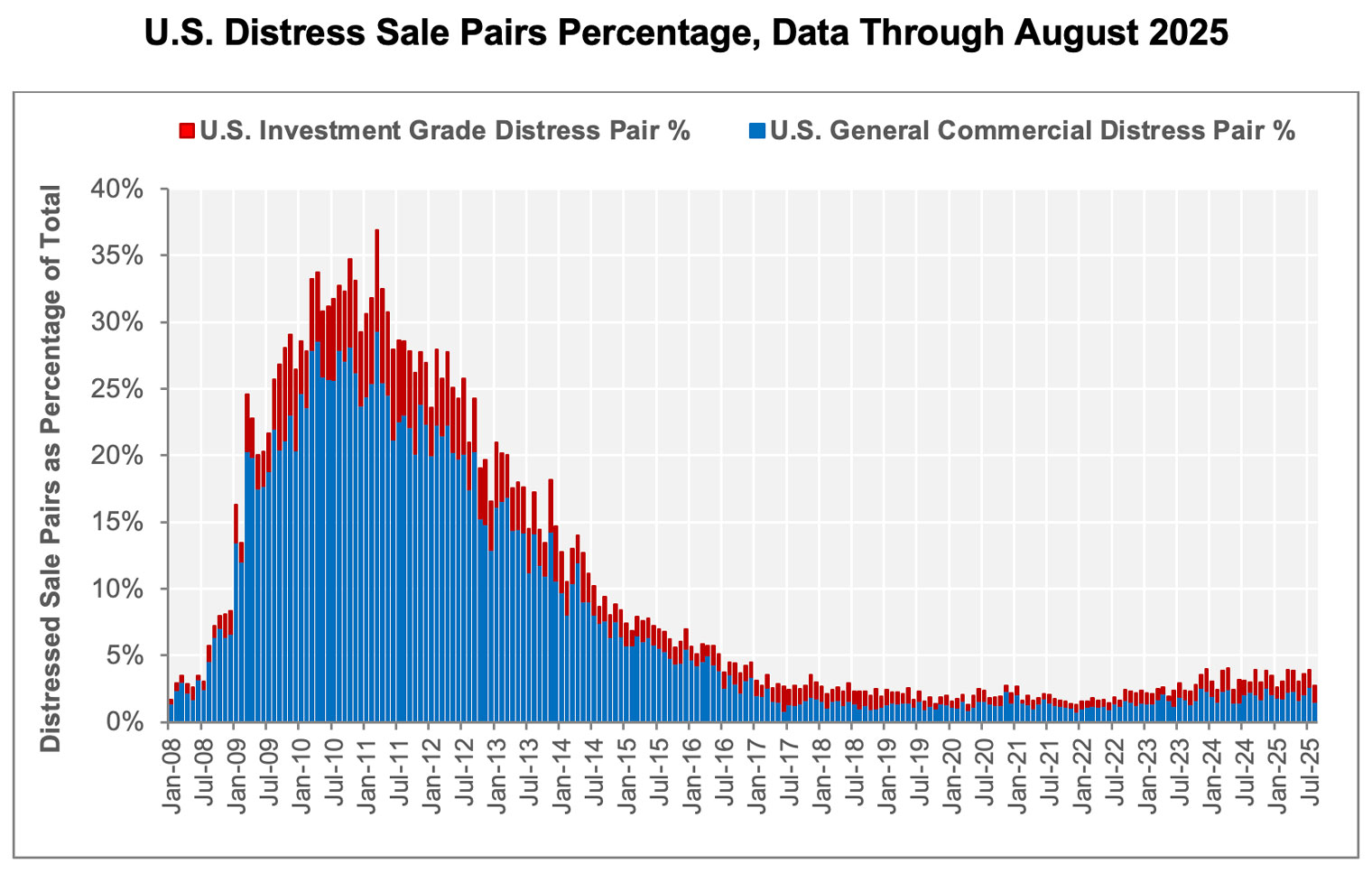

- DISTRESSED REPEAT-SALE TRADES DECLINED IN AUGUST 2025. Approximately 40 of the 1,479 repeat-sales trades in August 2025, or 2.7%, were distressed sales. 23 general commercial distressed sales totaled 1.8% of all general commercial repeat sales in August 2025. There were also 17 distressed investment grade repeat sales recorded in the month, accounting for 8% of all investment grade repeat sales.

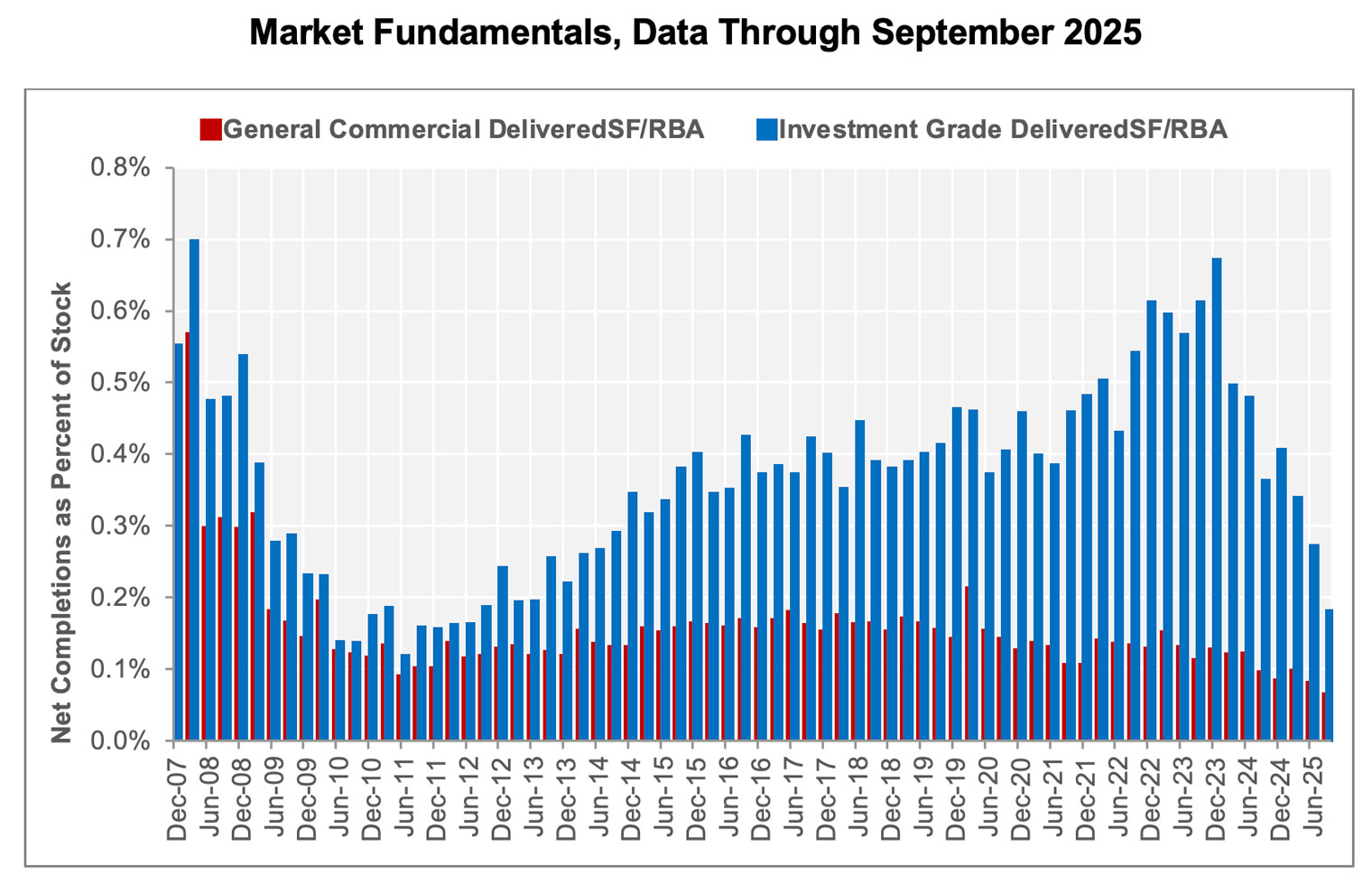

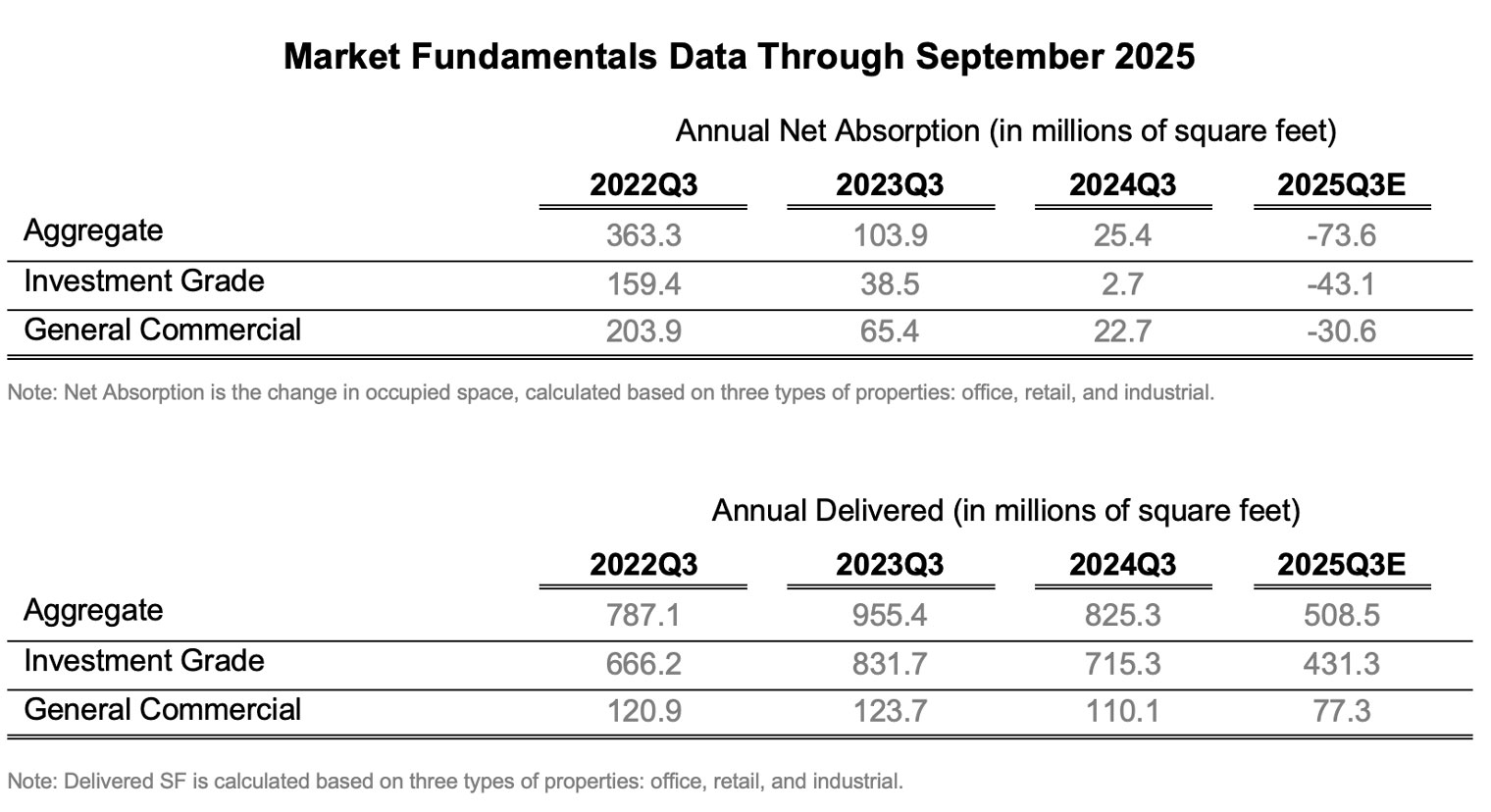

- DELIVERIES HAVE BEEN CUT IN HALF SINCE THE FOURTH QUARTER OF 2024. Deliveries across the three major property types — office, retail, and industrial — are projected to reach 80.1 million SF in the third quarter of 2025, the lowest level since the second quarter of 2012 and 31.6% below the second quarter of 2025.

- In the 12 months ending in September 2025, deliveries are expected to total 508.5 million SF, down 38.4% from the same period in 2024. Approximately 84.8% of the space delivered, or 431.3 million SF, is expected to be of investment grade quality. Only 77.3 million SF of general commercial properties are projected to be delivered in the 12 months ending in September 2025, a drop of 29.8% compared to the third quarter of 2024.

- As a percentage of total stock, deliveries are projected to add 0.1% to the total inventory in the quarter ending in September 2025. Investment grade deliveries are expected to enlarge its stock by 0.2%, while general commercial should grow by less than 0.1% of its current inventory.

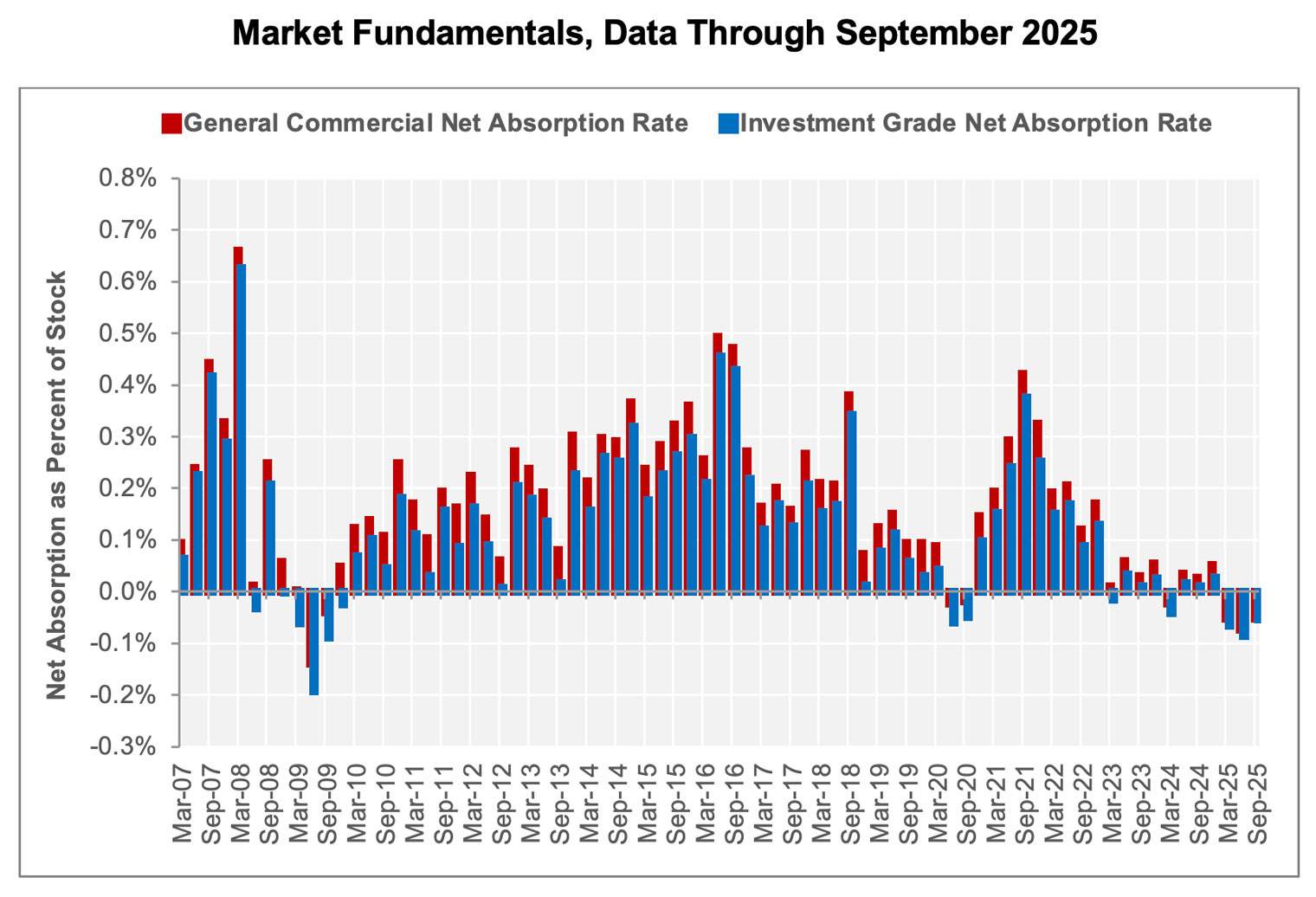

- THREE CONSECUTIVE QUARTERS OF NEGATIVE NET ABSORPTION. Net absorption across the three major property types — office, retail, and industrial — is projected to give back 25.8 million SF in the third quarter of 2025. Since the start of 2025, the market has given back 93.2 million SF of space.

- In the 12 months ending in September 2025, net absorption is expected to return 73.6 million SF to the market. Investment grade is projected to give back 58.5% of the total loss, while the general commercial segment is expected to contribute 41.5%. Since peaking in the third quarter of 2021, the most recent period marks the sixteenth quarter of declining 12-month net absorption.

- As a percentage of stock, negative net absorption in the quarter ending in September 2025 is projected to give back 0.1% of space, the third consecutive quarter of negative demand.

About The CoStar Commercial Repeat-Sale Indices

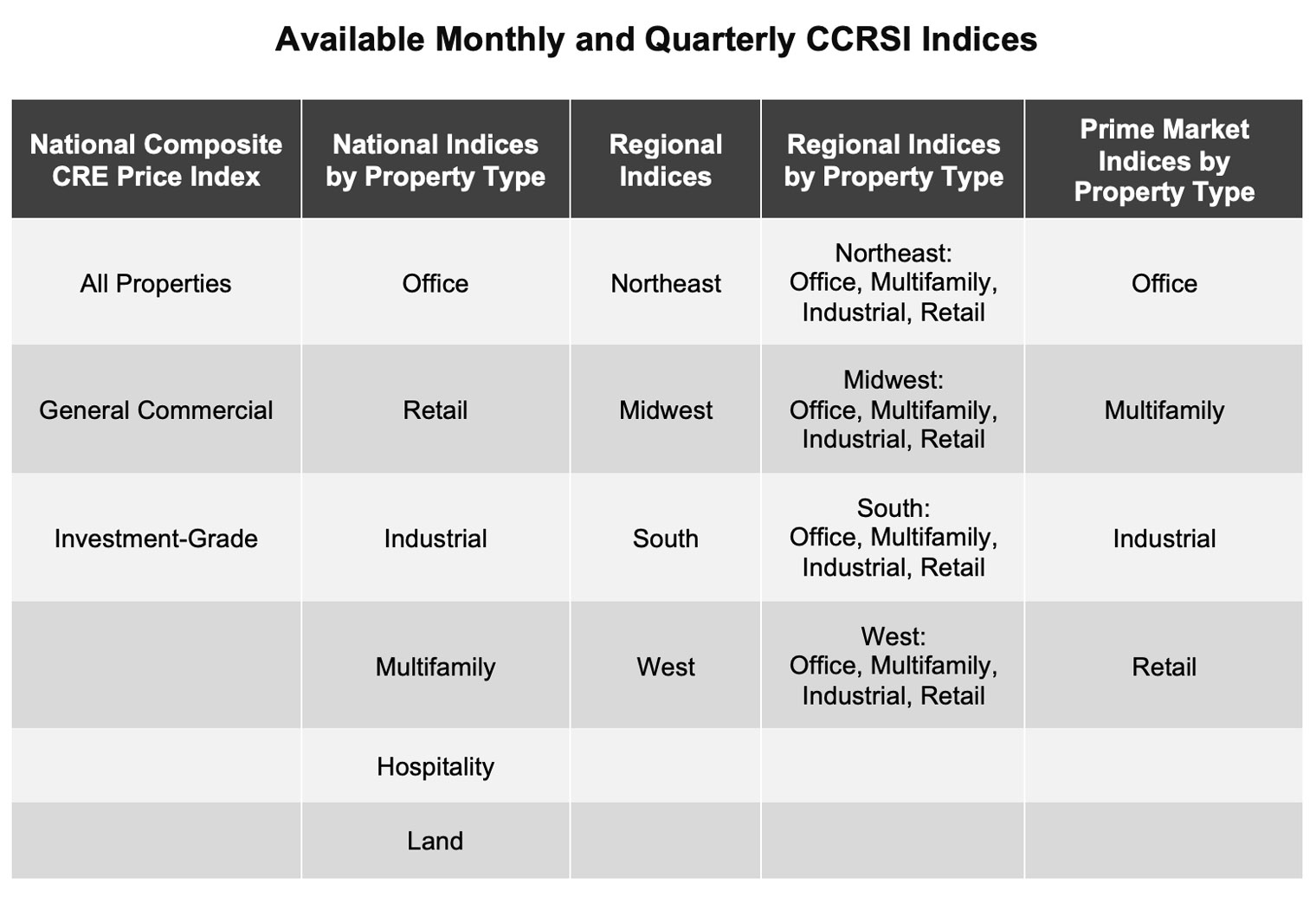

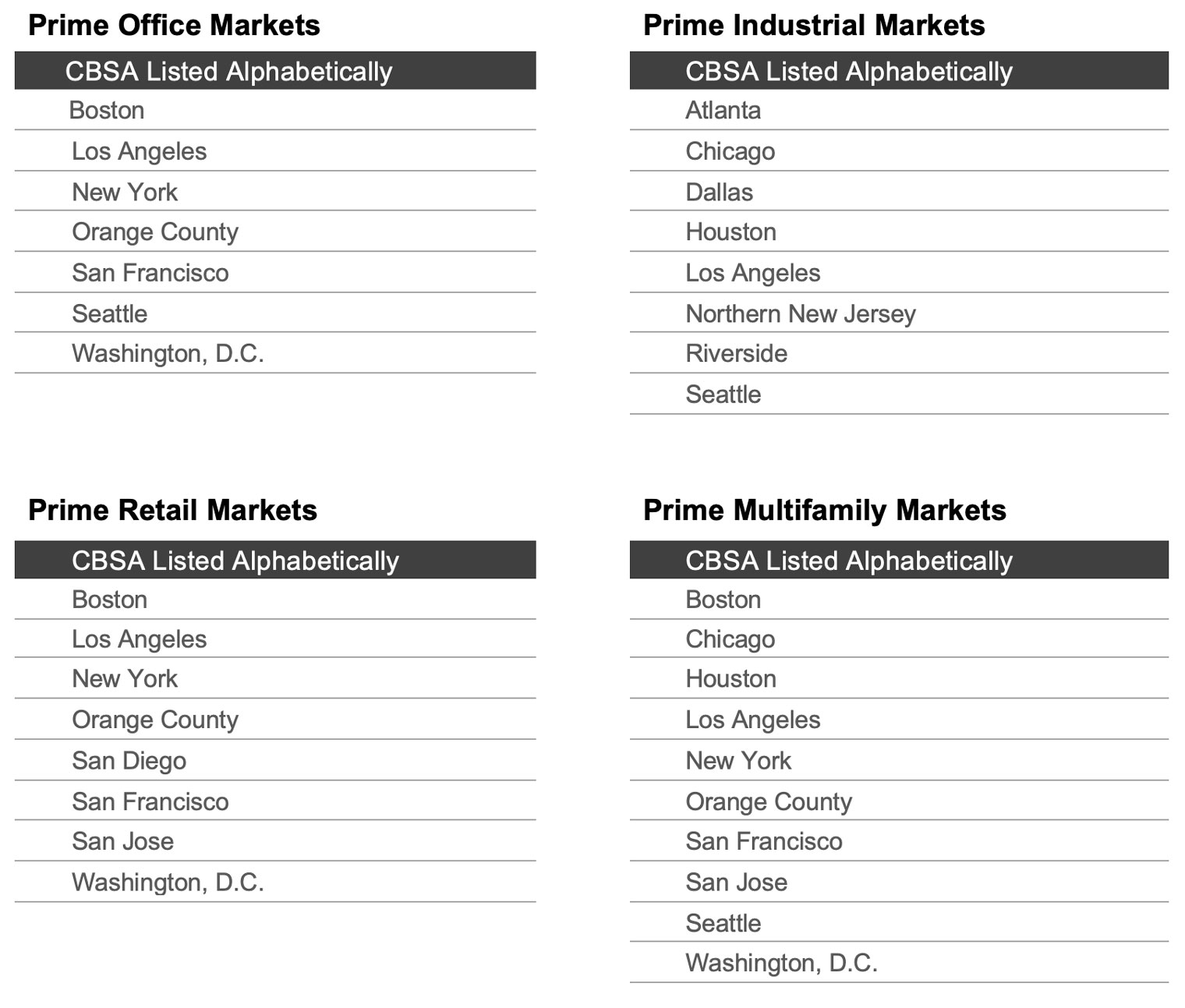

The CoStar Commercial Repeat-Sale Indices (CCRSI) is the most comprehensive and accurate measure of commercial real estate prices in the United States. In addition to the national Composite Index (presented in equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which we report monthly, we report quarterly on 30 sub-indices in the CoStar index family. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, which is widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. A sales pair is created when a property is sold more than once. The prices from the first and second sales are then used to calculate the property's price movement. The aggregated price changes from all the sales pairs create a price index.

MEDIA CONTACT:

Matthew Blocher, Vice President, CoStar Group Corporate Marketing & Communications (mblocher@costar.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit https://costargroup.com/costar-news/ccrsi/.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces, and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; Homes.com, the fastest-growing residential real estate marketplace; and Domain, one of Australia’s leading property marketplaces. CoStar Group’s industry leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible, STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted over 141 million average monthly unique visitors in the second quarter of 2025, serving clients around the world. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com.

This news release includes "forward-looking statements," including, without limitation, statements regarding CoStar's expectations, beliefs, intentions, or strategies regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that the trends represented or implied by the indices will not continue or produce the results suggested by such trends, including trends related to commercial real estate fundamentals, absorption, price growth, and tenant demand; the risk that the projected continued decrease in deliveries across the three major property types — office, retail, and industrial — is incorrect; the risk that September 2025 investment grade deliveries [and expected third quarter of 2025 Annual Net Absorption and Annual Delivered across the three major types — office, retail, and industrial — therefore ] is incorrect. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2024, and Quarterly Report on Form 10-Q for the quarter ending June 30, 2025, which is filed with the SEC, including in the “Risk Factors” section of that filing, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof. CoStar assumes no obligation to update or revise any forward-looking statements, whether due to new information, future events, or otherwise.