PRICES ROSE ON LARGE MAJOR ASSET TYPES IN 2025

CCRSI RELEASE – January 2026

(With data through December 2025)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through December 2025. Based on 2,129 repeat sale pairs in December 2025 and 338,467 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

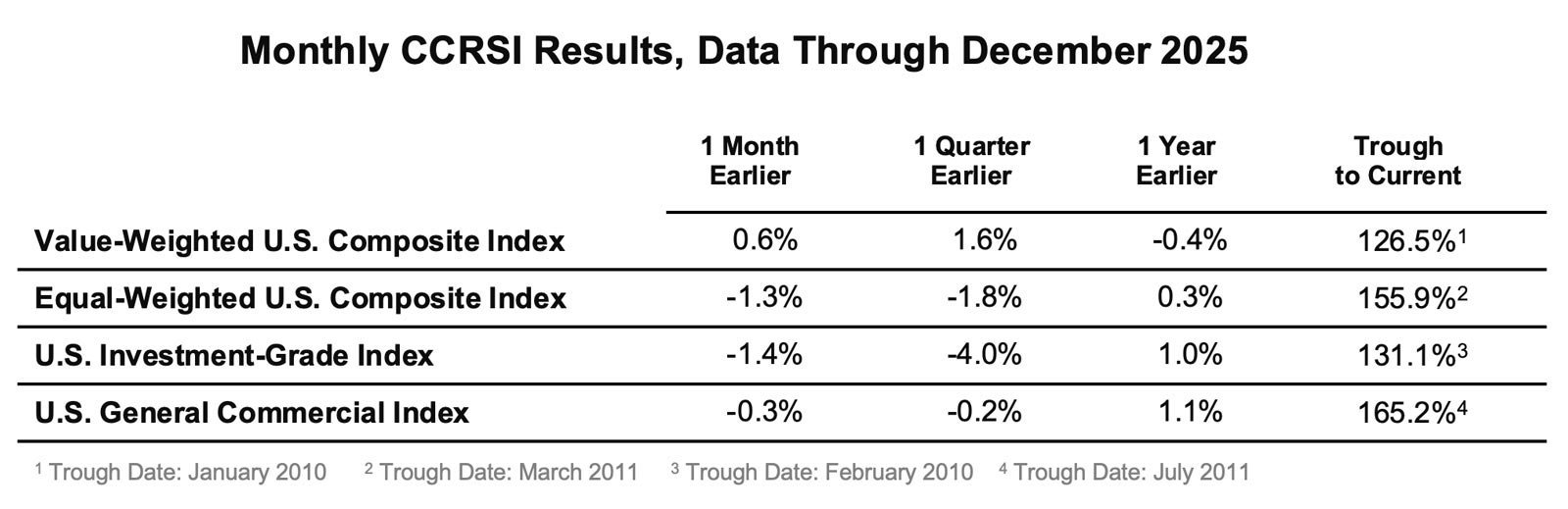

CCRSI National Results Highlights

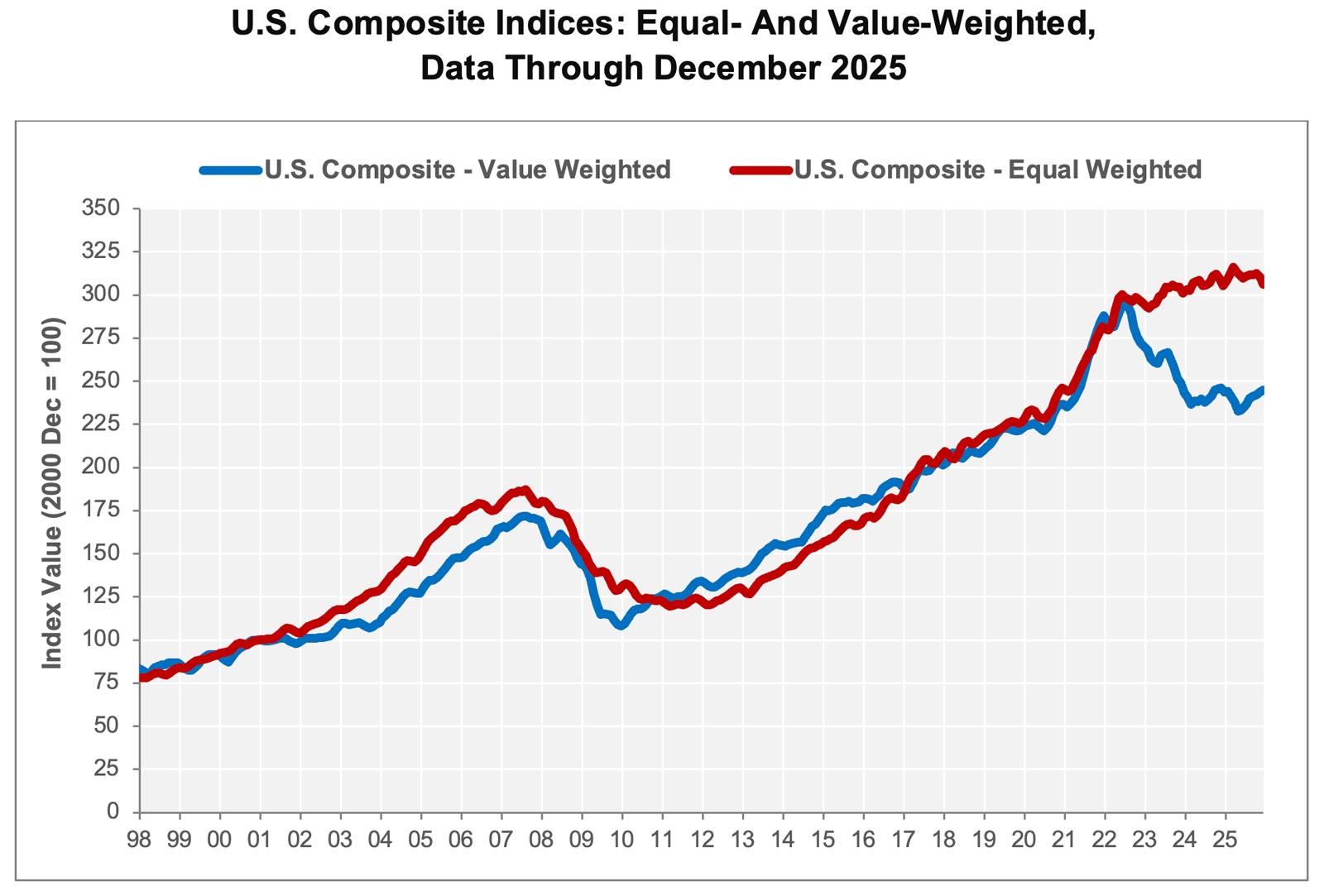

- U.S. COMPOSITE PRICE INDICES WERE MIXED IN DECEMBER 2025. The value-weighted U.S. Composite Index, which is more heavily influenced by high-value trades common in core markets, increased 0.6% over the prior month to 245 in December 2025, following seven consecutive months of gains. Year-over-year value declines slowed to 0.4% in December 2025 compared to losing 1.1% in December 2024 and 8.5% in December 2023. Prices in this cohort ended the year 17.1% below the July 2022 all-time high.

- Meanwhile, the equal-weighted U.S. Composite Index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, fell 1.3% over the prior month to 306 in December 2025. The index rose 0.3% during the 12 months ending in December 2025, sitting 3.1% below the March 2025 all-time high.

- Unlike the value-weighted segment’s annual rate of change improvement, the equal-weighted cohort’s annual price increase fell to 0.3% in December 2025, down from 1.9% in December 2023 and 1.5% in December 2024. A similar divergence was also evident in the years following the Great Recession, notably in 2010 and 2011.

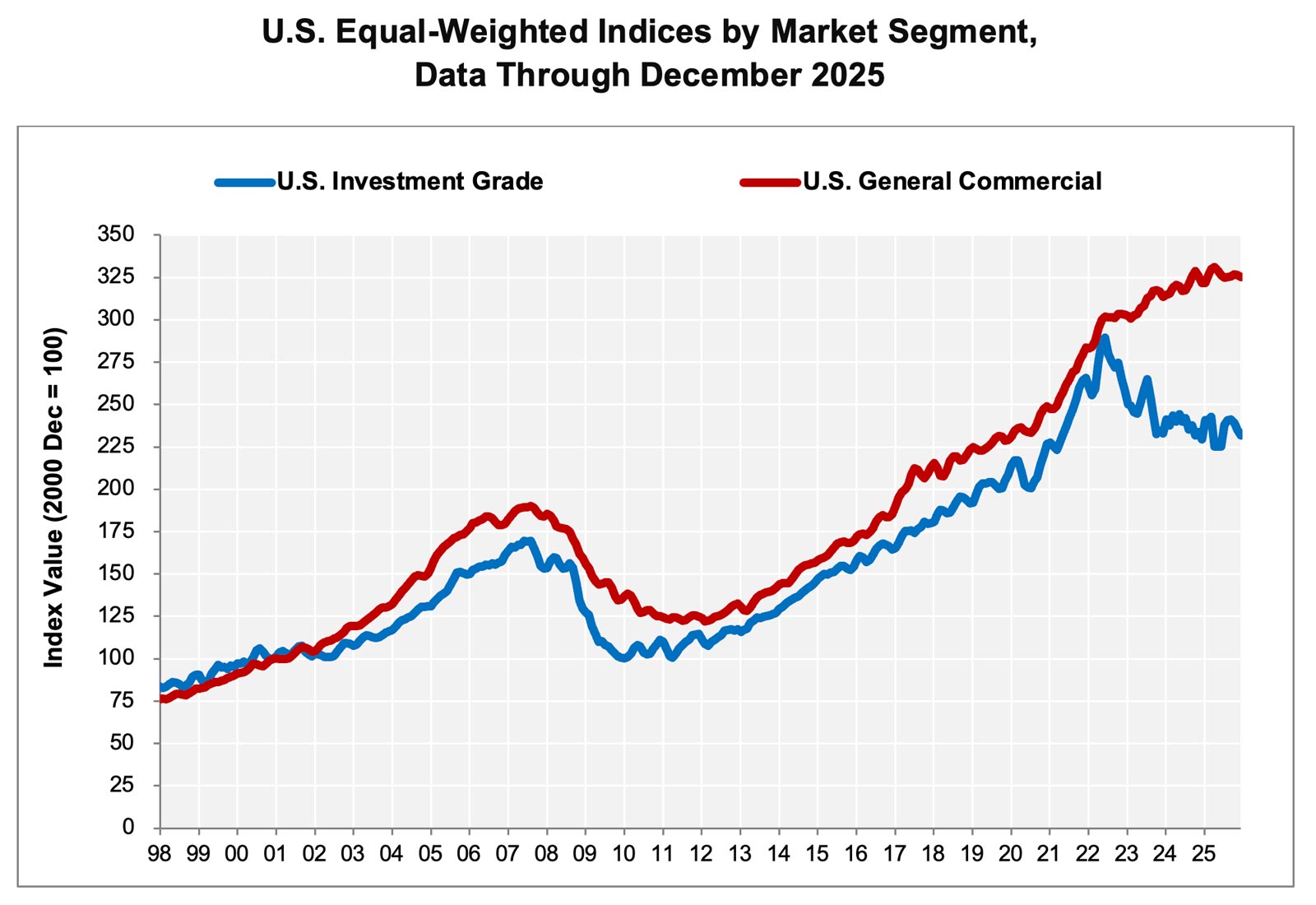

- EQUAL-WEIGHTED PRICE MEASURES ROSE COMPARED TO 2024. The investment grade and general commercial sub-indices increased in December 2025 compared to the prior year. The general commercial sub-index rose 1.1% compared to December 2024, while the investment grade sub-index gained 1% during the same period.

- In the short term, the investment grade sub-index, more heavily influenced by higher-value assets, fell 1.4% in December 2025, the third consecutive monthly decline over the prior month. The index was 20% lower than the June 2022 all-time high.

- The general commercial sub-index, more heavily influenced by smaller, lower-priced assets, also declined 0.3% in December 2025, the second consecutive month of declines over the prior month. This sub-index was 1.8% below the all-time high from April 2025.

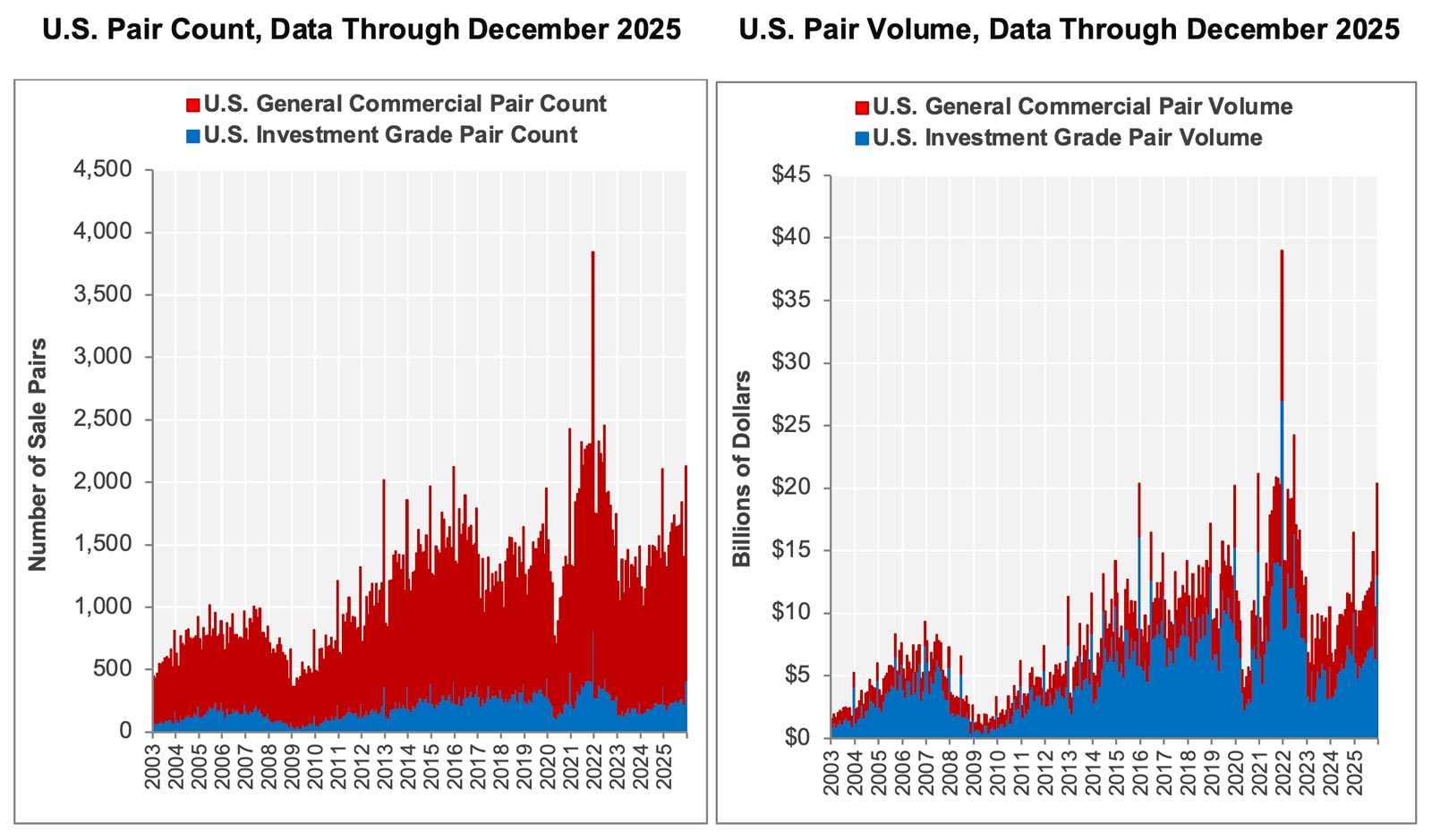

- TRANSACTION COUNTS INCREASED IN DECEMBER 2025. The number of repeat sales in December 2025 was 1% higher than December 2024. U.S. composite repeat sales volume also rose, up 23.9% compared to December 2024. The investment grade sub-index was 29.6% above December 2024 levels while the general commercial sales volume increased 14.9% compared to December 2024.

- The composite pair volume of $143.7 billion during the 12 months ending in December 2025 was 20.7% above the 12-month period that ended in December 2024. The growth in sales volume was most evident in the general commercial segment, which rose 21% over the 12 months that ended in December 2025 compared to the same period ending in December 2024. The general commercial segment accounted for 35.9% of the overall transaction volume during the 12 months that ended in December 2025. The investment grade segment, which accounted for 64.1% of the 12-month transaction volume, increased 20.5% over the 12 months ending December 2025.

- TRANSACTION COUNTS INCREASED IN DECEMBER 2025. The number of repeat sales in December 2025 was 1% higher than December 2024. U.S. composite repeat sales volume also rose, up 23.9% compared to December 2024. The investment grade sub-index was 29.6% above December 2024 levels while the general commercial sales volume increased 14.9% compared to December 2024.

- The composite pair volume of $143.7 billion during the 12 months ending in December 2025 was 20.7% above the 12-month period that ended in December 2024. The growth in sales volume was most evident in the general commercial segment, which rose 21% over the 12 months that ended in December 2025 compared to the same period ending in December 2024. The general commercial segment accounted for 35.9% of the overall transaction volume during the 12 months that ended in December 2025. The investment grade segment, which accounted for 64.1% of the 12-month transaction volume, increased 20.5% over the 12 months ending December 2025.

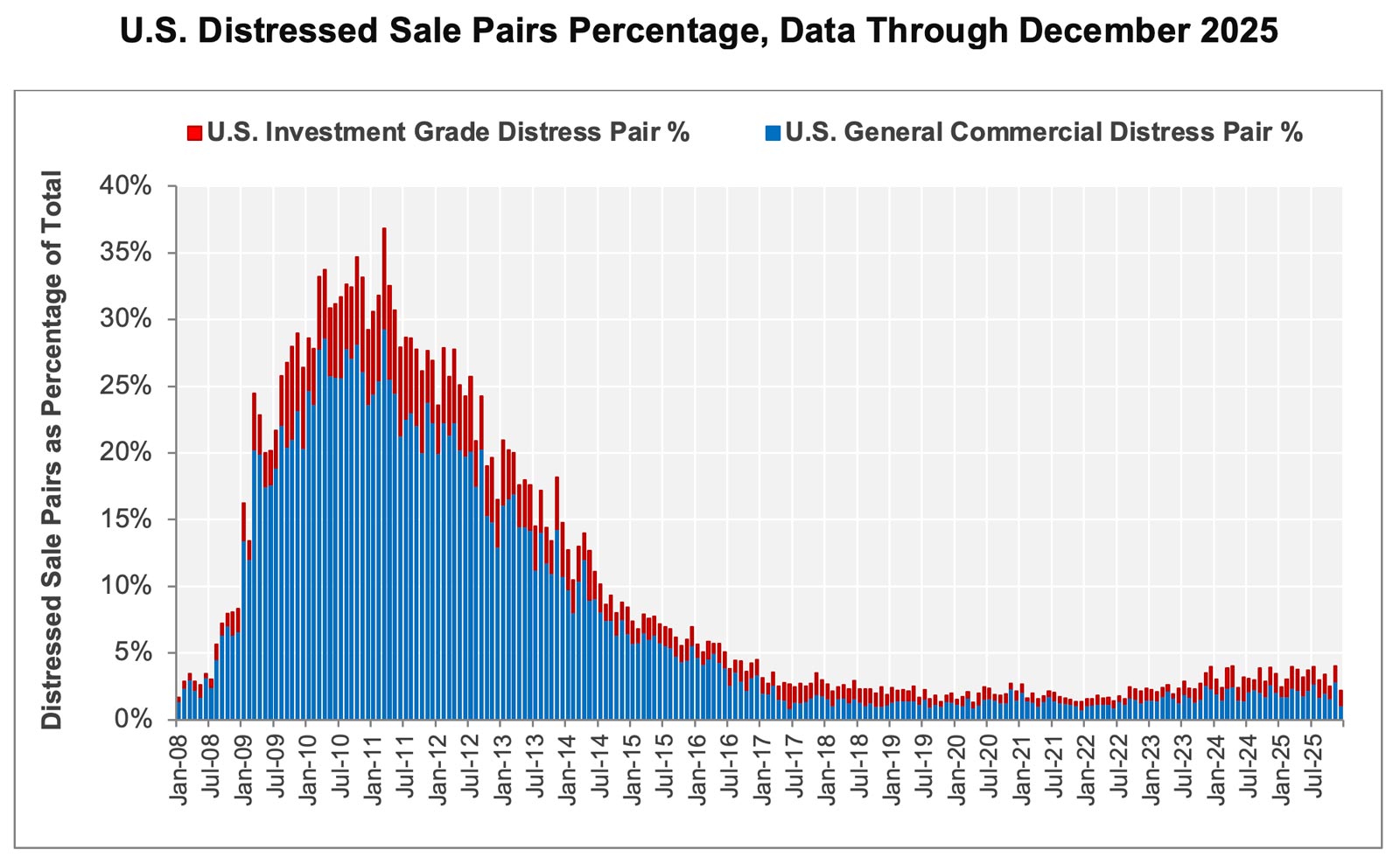

- DISTRESSED REPEAT SALES FELL IN DECEMBER 2025. 46 of the 2,129 repeat sales were distressed in December 2025, about 2.2% of all repeat sales and the lowest rate of distressed repeat sales since May 2023. There were 23 distressed general commercial sales in December 2025, equating to 1.3% of all general commercial repeat sales. This was the lowest level of general commercial distress since June 2022. There were 23 distressed investment-grade sales recorded in December 2025, accounting for 5.6% of all investment-grade repeat sales and down from around 10% in the second quarter of 2025.

Quarterly CCRSI Property Type Results

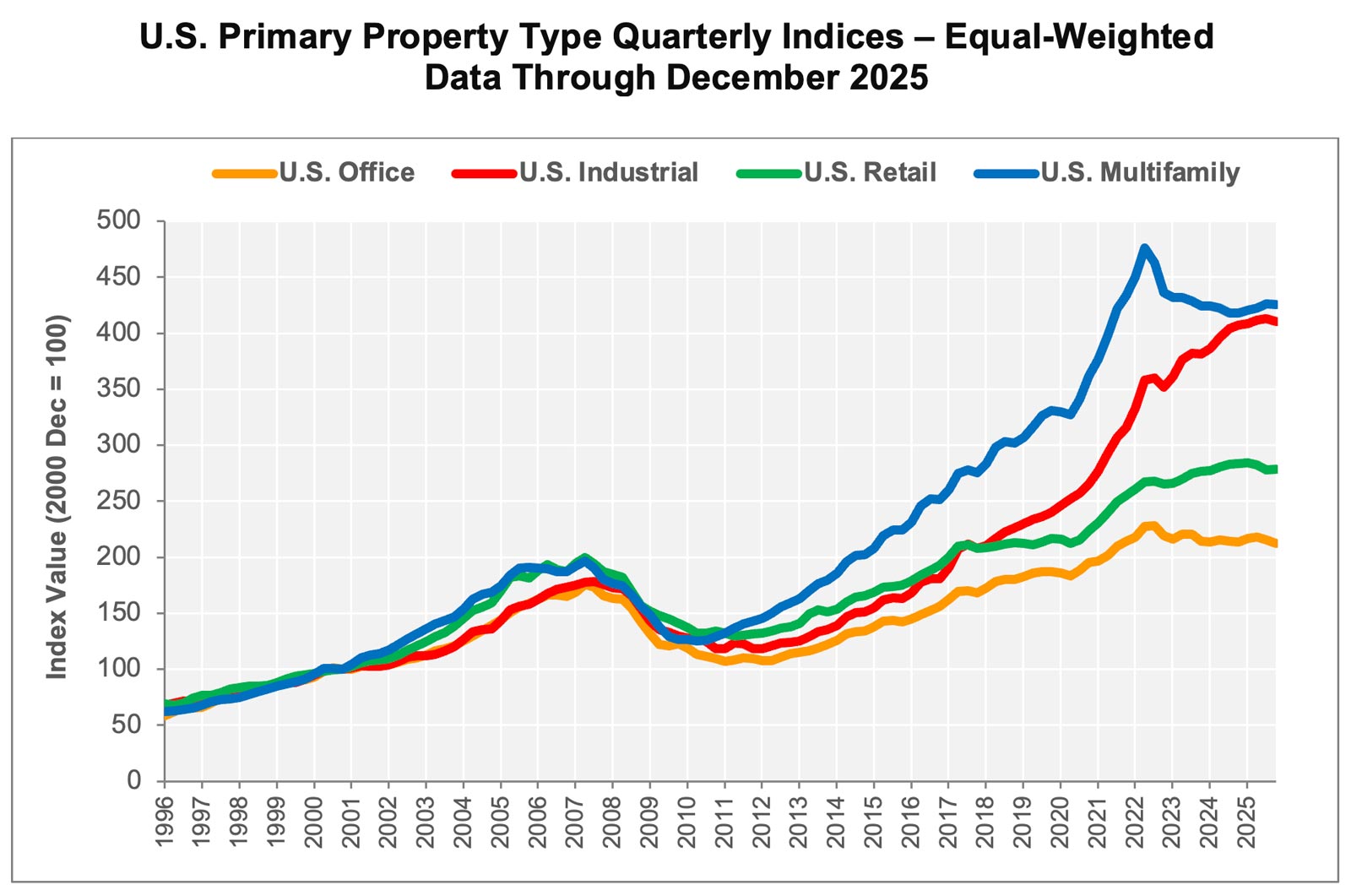

- MAJOR PROPERTY TYPES SAW VALUE-WEIGHTED PRICE INCREASES IN 2025. The value-weighted price indices among the four major property types saw increases in 2025, led by office, increasing 3.8% in the 12 months ending in December 2025. Multifamily rose 0.7% during the same period while both industrial and retail increased 0.4% since December 2024.

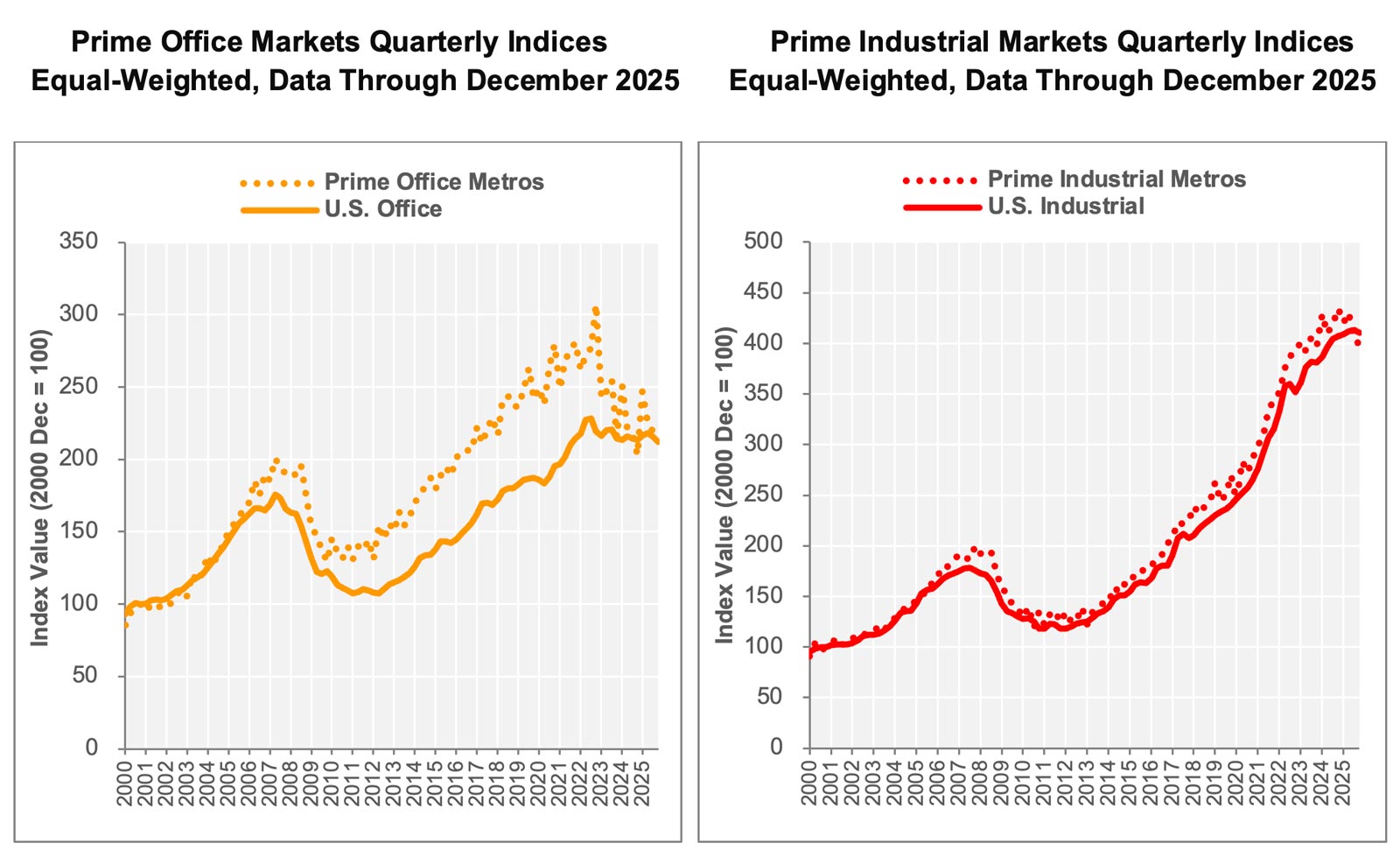

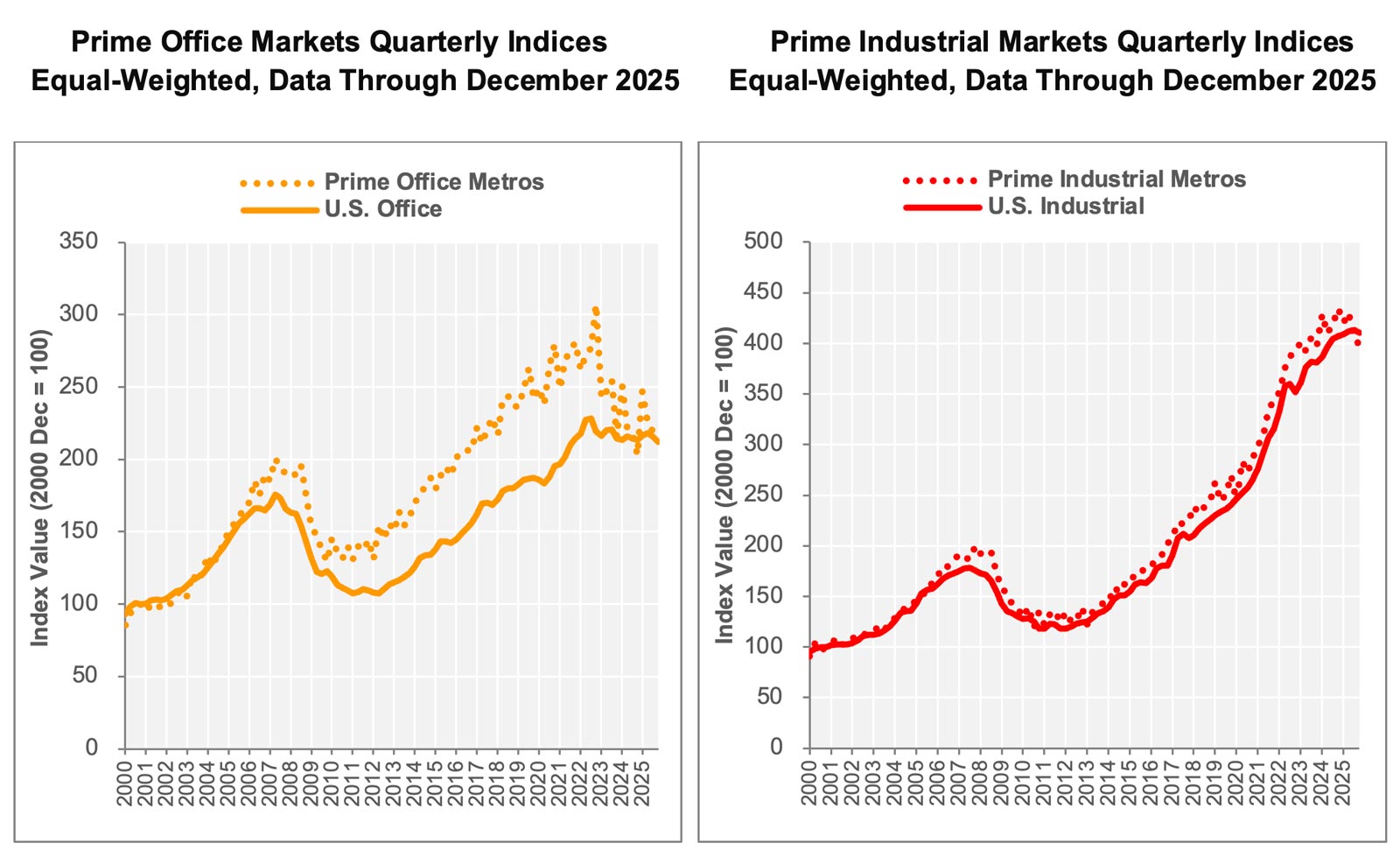

- VALUE-WEIGHTED OFFICE WAS THE NOTABLE STANDOUT IN 2025. Sizeable office developments in larger markets witnessed substantial price increases in 2025, increasing 3.8% during the 12 months ending December 2025. Prime office markets witnessed an 11.1% spike in equal-weighted office pricing in 2025. However, equal-weighted office prices more broadly failed to match, falling 0.6% since December 2024 and 1.7% since the third quarter of 2025.

- MULTIFAMILY PROPERTIES ALSO APPRECIATED IN 2025. The equal-weighted multifamily index increased 1.9% in the 12 months ending December 2025 while the value-weighted segment climbed 0.7% during the same period. Compared to the third quarter of 2025, smaller property values gave back 0.2% while larger assets claimed 2% increases. Prime multifamily markets saw price increases in the prior two quarters, up 2.6% in the fourth quarter alone, but fell 3.5% since December 2024.

- INDUSTRIAL PRICE INCREASES SLOWED IN 2025. After leading the value-weighted pricing segment for much of 2025, the industrial property type saw annual price increases slow to 0.4%. The equal-weighted pricing segment fared better at 0.9% during the 12 months ending December 2025. Compared to the most recent quarter, both segments fell, declining 1.1% among larger assets and 0.6% among smaller assets. Prime industrial markets also showed weakness, falling 8.3% since December 2024 and 1.9% since the third quarter of 2025.

- RETAIL PRICE PERFORMANCE DIVERGED BETWEEN LARGE AND SMALL ASSETS. The value-weighted retail segment saw pricing climb 0.4% in the 12 months ending in December 2025 while the equal-weighted cohort declined 1.9% in the same period. Compared to the third quarter of 2025, smaller retail asset values rose 0.1% and larger asset values fell 0.7%. Prime retail metros lost value over both time horizons, falling 0.4% in the last 12 months ending December 2025 and 2.4% compared to the prior quarter.

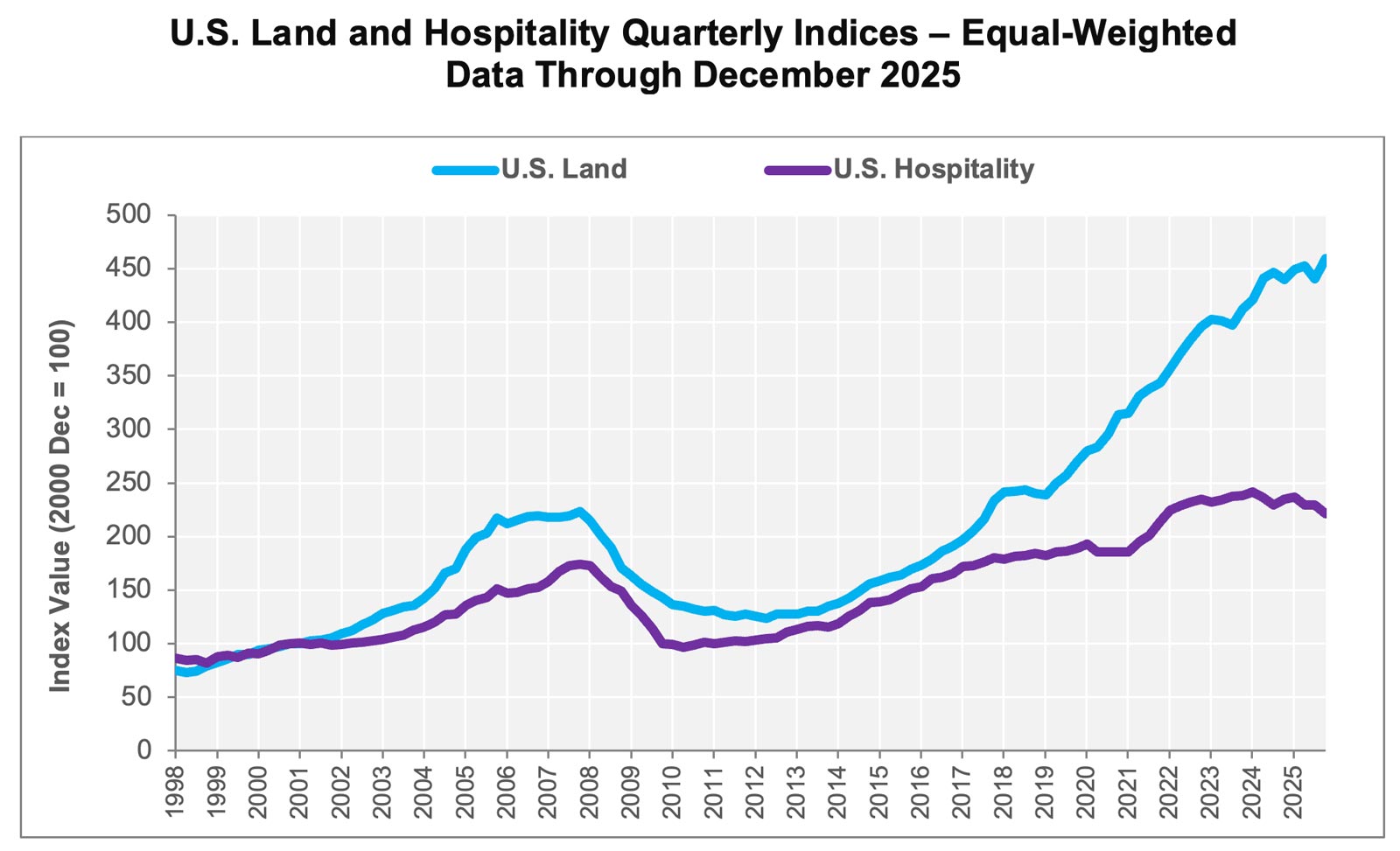

- EQUAL-WEIGHTED HOSPITALITY PRICES FELL IN 2025. The equal-weighted hospitality index declined 3.5% in the fourth quarter of 2025 compared to the prior quarter and 5.8% during the 12 months ending December 2025.

- LAND PRICES JUMPED IN THE FOURTH QUARTER OF 2025. The equal-weighted land index is historically a volatile property type index. It rose 4.4% in the fourth quarter of 2025 and 4.5% above the fourth quarter of 2024.

Quarterly CCRSI Property Type Results

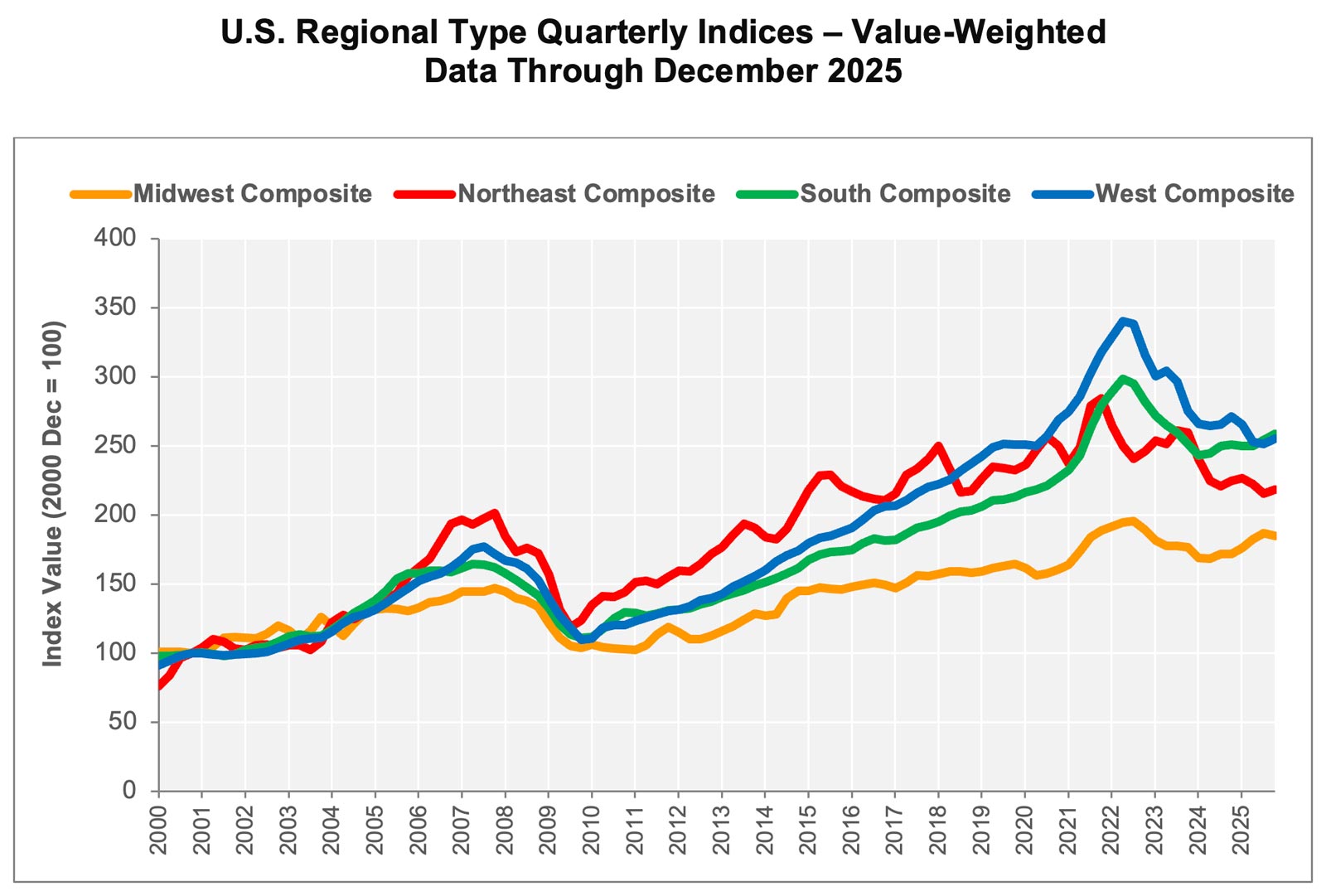

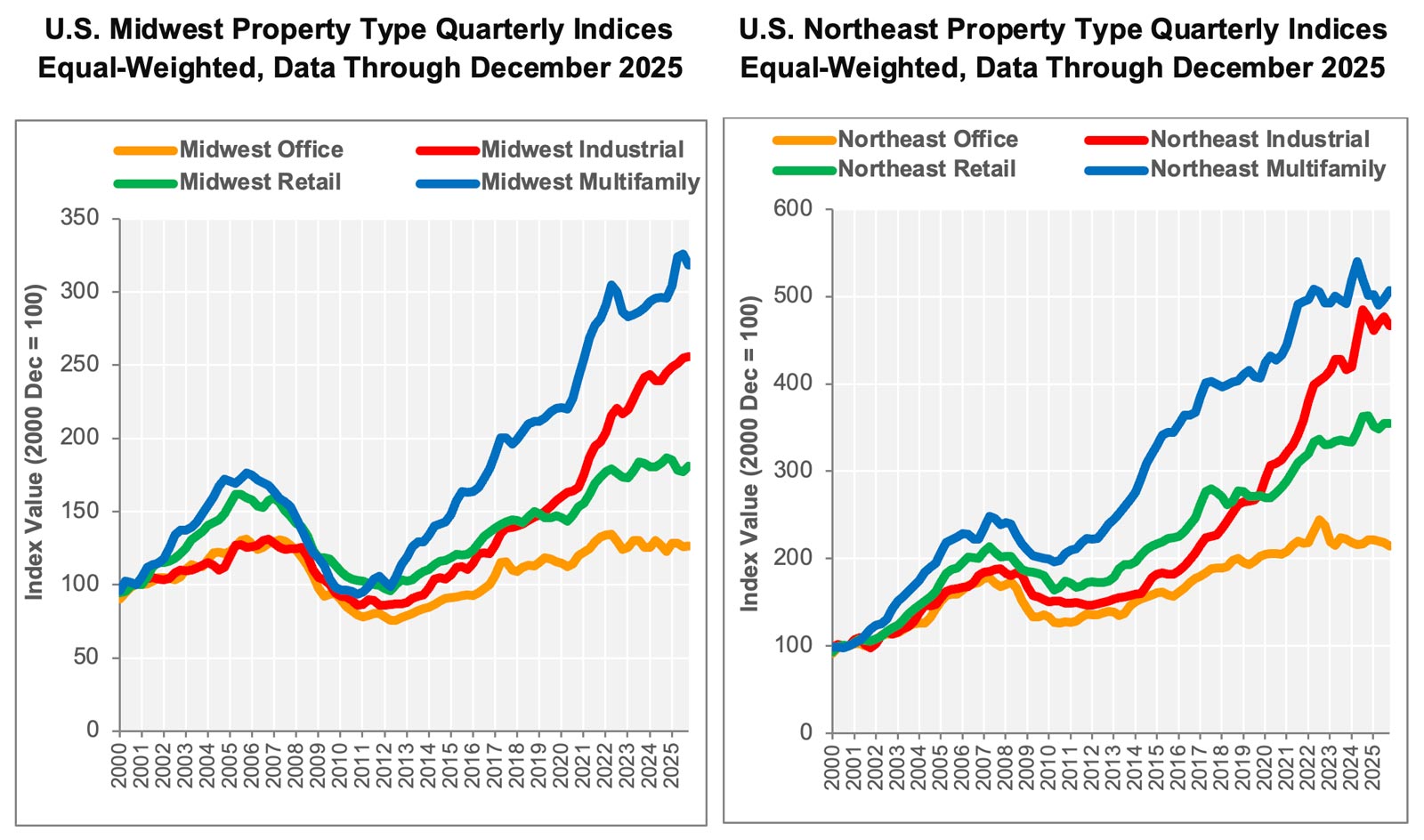

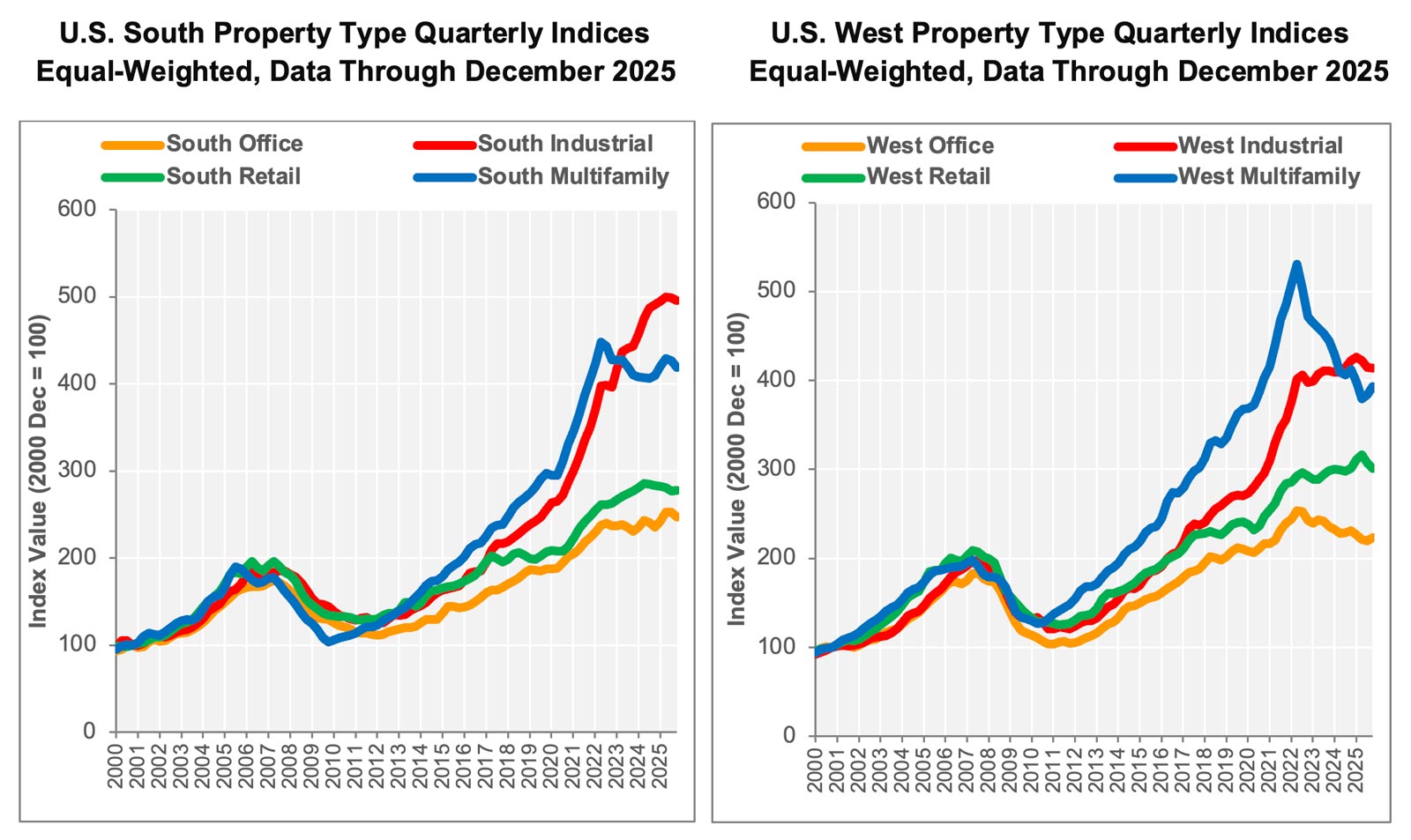

- REGIONAL PRICE CHANGES WERE EVENLY SPLIT ACROSS PROPERTY TYPES. Each geographic region's four main property types produce 16 total property-type regions. Half of the 16 property-type regions showed price declines over the prior quarter, while the remainder saw increases.

- SOUTH REGION. The South’s equal-weighted repeat-sale index declined 2% during the fourth quarter of 2025 from the prior quarter, while the value-weighted index rose 1.8% in the same period. Compared to the fourth quarter of 2024, the equal-weighted index inched 0.3% higher, and the value-weighted index rose 3.1%. The South witnessed price declines across three property types in the fourth quarter of 2025, with office, multifamily, and industrial falling 2.4%, 1.8% and 0.6%, respectively, over the prior quarter. Retail was the lone property type to see increases in the fourth quarter of 2025, rising 0.4% over the prior quarter. Compared to the fourth quarter of 2024, office gained 4.7%, multifamily grew 2.2%, and industrial rose 0.9% in the fourth quarter of 2025. During the same period, retail dropped 1.7% compared to the fourth quarter of 2024.

- NORTHEAST REGION. The equal-weighted Northeast index was flat in the fourth quarter of 2025 and increased 0.1% from the prior year. The value-weighted index advanced 1.5% over the prior quarter and fell 2.7% compared to the fourth quarter of 2024. Multifamily prices increased 1.8% in the fourth quarter of 2025 compared to the prior quarter. Meanwhile, industrial fell 2.2%, office shed 1.9%, and retail gave back 0.1% of value compared to the previous quarter. Compared to the fourth quarter of 2024, three of the four property types were down. Office decreased 3.1%, retail fell 2.4%, and industrial declined 2.1%. Multifamily was alone in price gains, up 1.1% since December 2024.

- MIDWEST REGION. The Midwest equal-weighted repeat-sale index rose 0.4%, while the value-weighted segment fell 1% in the fourth quarter of 2025. Compared to December 2024, the equal-weighted index increased 0.3% as the value-weighted index spiked 7.4% in December 2025. Retail increased 2.2% over the third quarter of 2025 while office and industrial stepped 0.5% higher. Multifamily fell 2.4% compared to the third quarter of 2025. Compared to the fourth quarter of 2024, multifamily advanced 7.5%, industrial grew 4.5%, while office gained 3.2% and retail shed 2.9% of value.

- WEST REGION. The equal-weighted West index lost 0.7% in value in the fourth quarter of 2025 and 2.6% compared to the prior year. The value-weighted index advanced 1.7% in the fourth quarter of 2025 but gave back 5.8% compared to the fourth quarter of 2024. The West multifamily index was best over the prior quarter, up 2.3% while office gained 1.7%, industrial trimmed 0.1% and retail shed 2.1% of value. Compared to the fourth quarter of 2024, prices were down. Multifamily lost 4.7%, office declined 3.2%, and industrial fell 2%. Retail eked out a 0.1% gain on the prior year.

About The CoStar Commercial Repeat-Sale Indices

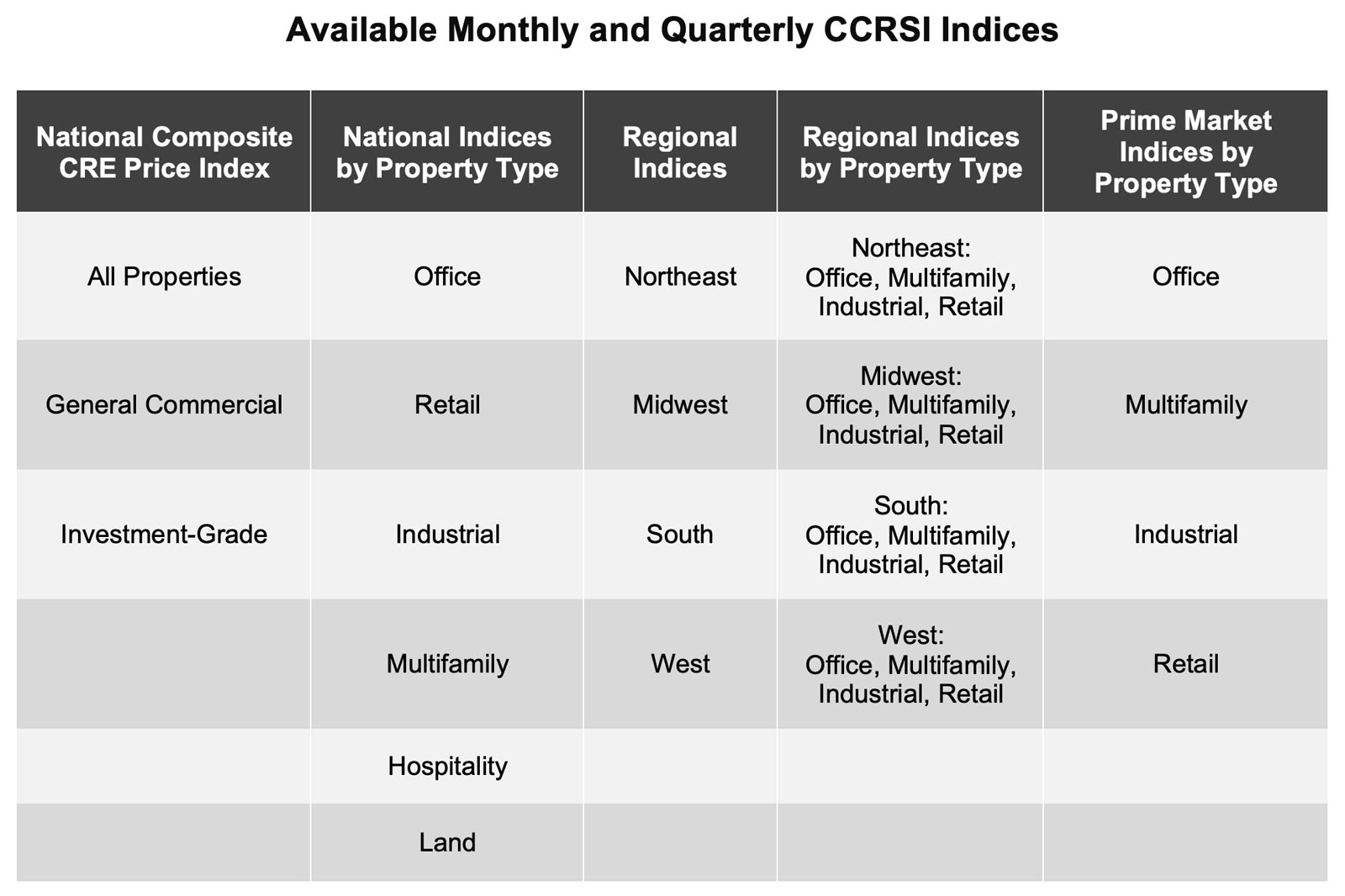

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which are reported monthly, 30 sub-indices in the CoStar index family are reported quarterly. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country). The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as new data is recorded.

MEDIA CONTACT:

Matthew Blocher, Vice President, CoStar Group Corporate Marketing & Communications (mblocher@costar.com).

For more information about the CCRSI Indices, including the complete accompanying data set and research methodology, legal notices and disclaimer, please visit https://costargroup.com/costar-news/ccrsi/.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; www.Apartments.com, the leading platform for apartment rentals; www.Homes.com, the fastest-growing residential real estate marketplace; and Domain, one of Australia’s leading property marketplaces. CoStar Group’s industry-leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible, STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted an average of 143 million unique monthly visitors in the third quarter of 2025, serving clients worldwide. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com.